Who We Serve

Payers - Medicare Advantage

Risk Adjustment Data Submission & Analytics

Closing Care Gaps. Maximizing Reimbursement. Staying CMS-Compliant.

For Medicare Advantage (MA) plans, success depends on accurate risk adjustment data submissions and smart analytics. CMS requires encounter data (EDS) submissions through the MARx and Encounter Data System, and even small errors can mean missed reimbursement opportunities.

That’s where Health Data Max comes in.

End-to-End Risk Adjustment Submission Support. At Health Data Max, we:

Ingest and validate your claims and encounter data

Certify submissions to the CMS MARx Portal on your behalf

Track every stage of the submission pipeline:

999s (acknowledgement)

277CAs (status)

MAO-002s (encounter feedback)

MAO-004s (risk adjustment reports)

MORs/MMRs (monthly membership & risk adjustment reports)

With our platform, you always have a complete picture of your submission status—at your fingertips.

Advanced Risk Adjustment Analytics

Our analytics engine doesn’t stop at submission. Post-submission, we generate insights that matter:

Risk Scores by Member & Provider

Evaluate provider performance and member-level RAF scores using CMS-HCC risk models.High-Chronic Patient Reporting

Identify the top 3% of chronic patients who typically drive up to 50% of costs—and close their care gaps first.Submission Error Prioritization

Detect the most common coding and file errors, and correct them at the source for higher CMS acceptance rates.Quality & Care Gap Tracking

Spot preventive and chronic care gaps in real time to improve Stars performance and patient outcomes.

Why Health Data Max?

Maximized Reimbursement → Accurate RAF capture, cleaner CMS acceptance, and minimized revenue leakage.

Compliance-First → Fully aligned with CMS encounter data submission requirements.

Actionable Visibility → Provider-level dashboards to track coding accuracy, care gap closure, and chronic condition documentation.

Smarter Focus → Redirect time from error-chasing to improving patient care.

In Medicare Advantage, precision is everything. The plans that master risk adjustment data submissions—and act on analytics—lead in both compliance and revenue.

Contact Us Today to learn how HDM can simplify your EDS submissions and unlock deeper insights.

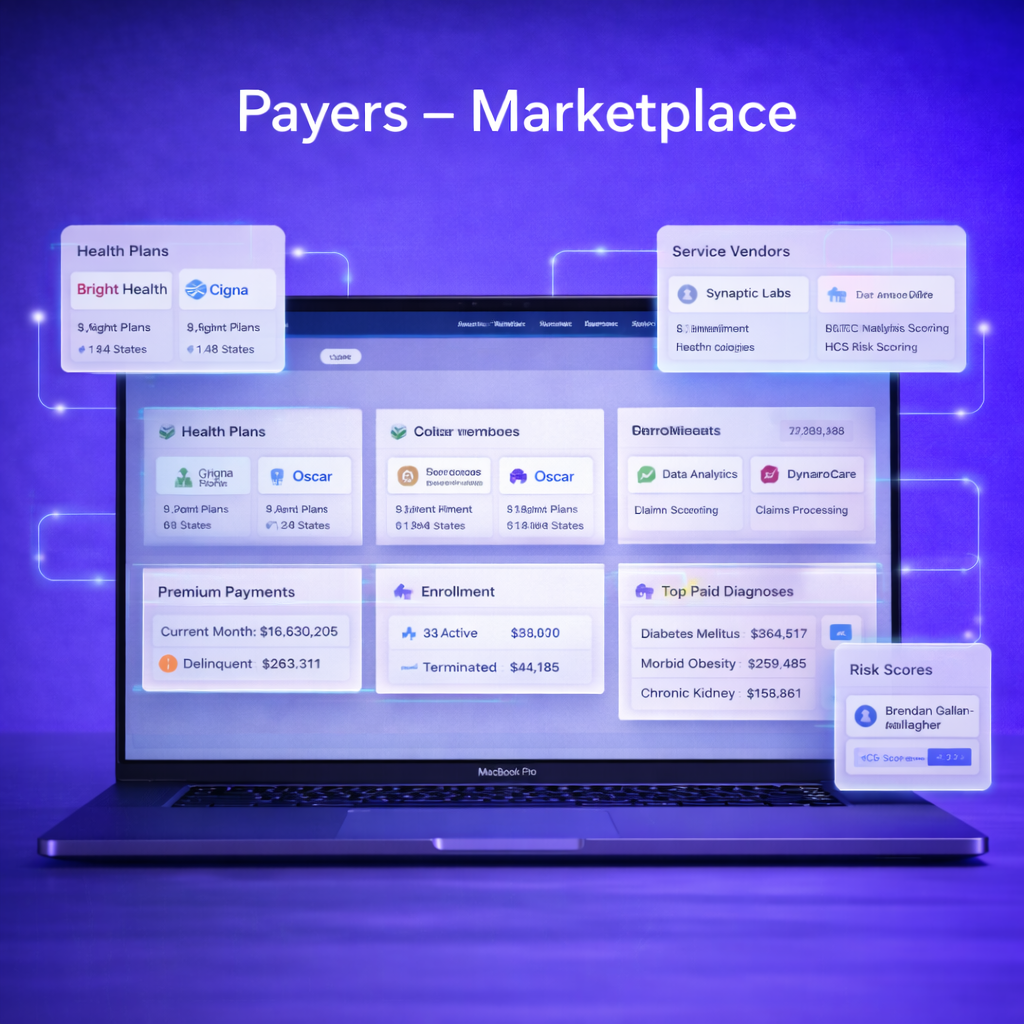

ACA Risk Adjustment (Payers - Marketplace)

Smarter Programs for Marketplace Plans

The Affordable Care Act (ACA) opened new opportunities for payers but also introduced unique challenges. Since plans cannot deny coverage based on pre-existing conditions, issuers face significant financial risk when a higher proportion of high-cost members enroll.

That’s why a robust ACA Risk Adjustment Program is essential—just as in Medicare Advantage. But there’s one critical difference: under the ACA model, a portion of premiums—sometimes as high as 25% of total revenue—is redistributed from lower-risk to higher-risk plans. Accuracy isn’t just compliance; it directly impacts financial performance.

How It Works

To measure risk accurately, ACA issuers must submit encounter and supplemental chart review data in XML format through the HHS EDGE Server. This process validates data, ensures inclusion in transfer calculations, and prevents penalties or default charges for incomplete submissions.

Similar to Medicare Advantage’s CMS-HCC risk models, HHS applies its own HHS-HCC models, updated annually. The key distinction?

Medicare Advantage: risk scores are calculated at the member level.

ACA Marketplace: scores are calculated at the plan level, with payments and transfers redistributed across issuers.

Why It Matters

Accuracy = Advantage → Plans that deliver complete, high-quality EDGE submissions see fairer risk transfer payments.

Compliance is Critical → CMS requires both minimum data quantity and quality thresholds to avoid default charges.

HHS Updates Annually → Using EDGE data, HHS recalibrates models regularly, meaning plans must stay proactive to remain competitive.

The Bottom Line

In the ACA Marketplace, the savviest plans win by submitting the most accurate data. With Health Data Max, you don’t just meet EDGE requirements—you maximize risk capture, protect revenue, and stay audit-ready.

Providers

Empowering Accurate Coding, Quality Care, and Shared-Savings Success

As Medicare Advantage (MA) grows—now covering more than 33 million beneficiaries in 2024 (CMS)—payers and providers face increasing pressure to close coding and care gaps, improve quality scores, and protect revenue in risk-sharing arrangements.

That’s where Health Data Max (HDM) helps providers thrive.

Why Providers Choose HDM

1. End-to-End Risk Adjustment

Streamline HCC coding with AI-powered chart review and clinical validation.

Ensure complete and compliant diagnosis capture for accurate RAF scoring.

Strengthen RADV and audit readiness with built-in traceability and CMS-aligned workflows.

Ensure accurate RAF scoring and prevent revenue leakage.

2. HEDIS & Quality Performance

Track Star Ratings and HEDIS metrics in real time.

Identify care gaps across preventive screenings, chronic conditions, and follow-up measures.

Equip providers with actionable insights to improve outcomes and performance bonuses.

3. Advanced Analytics + NLP

Combine structured claims with unstructured clinical data (notes, discharge summaries, labs).

Use Natural Language Processing (NLP) to surface missed diagnoses and coding opportunities.

Gain a 360° view of each member’s health status.

4. Proactive High-Risk Patient Management

Flag rising-risk and high-utilization members early.

Optimize care management programs to reduce avoidable admissions.

Improve population health while meeting CMS quality thresholds.

The HDM Advantage

Accuracy + Compliance → Ensure CMS submissions are clean, timely, and audit ready.

Better Care, Better Scores → Improve HEDIS/Stars performance with AI-backed insights.

Revenue Protection → Capture every valid HCC to optimize risk scores.

Transparency → Dashboards give payers full visibility into provider and program performance.

With HDM, providers gain a trusted partner that combines advanced analytics, NLP, and CMS-compliant workflows—helping you deliver better care while strengthening financial results

It’s your data. Let’s make it work harder.

ACO & VBC Networks

For ACOs: Make Risk Adjustment a Competitive Advantage

Value-based care is now the norm—not the exception. CMS continues to expand ACO participation and front-load primary-care investment (e.g., ACO Primary Care Flex in MSSP starting 2025–2029, and the Making Care Primary model launched July 1, 2024), reinforcing accurate documentation, coordinated care, and equity as core levers for performance. Centers for Medicare & Medicaid Services

Why Risk Adjustment Matters in ACOs

Payment fairness & benchmark accuracy. Risk adjustment normalizes for patient complexity so organizations caring for sicker populations aren’t penalized—and performance is compared on the care delivered, not the case mix. CMS models (e.g., CMS-HCC) use ICD-10 diagnosis codes to calculate risk scores. Centers for Medicare & Medicaid Services

Better population management. Accurate coding surfaces high-risk and rising-risk members for intervention and underpins financial forecasts and shared-savings strategies in MSSP and other CMMI models. Centers for Medicare & Medicaid Services

Consistent with current CMS models. CMS’ ongoing primary-care and ACO initiatives (e.g., ACO PC Flex, MCP) are designed to strengthen care teams and infrastructure—exactly where accurate, timely risk capture pays dividends. Centers for Medicare & Medicaid Services

Bottom line: Accurate, compliant documentation → reliable risk scores → fairer benchmarks, better care targeting, and stronger shared-savings potential.

How HDM Helps Your ACO Win

HDM Risk Adjustment Platform aligns frontline documentation with analytics and compliance—purpose-built for ACO operations.

AI-Powered Documentation Integrity

NLP + rules detect missed or unspecified diagnoses in notes, discharges, and labs; align to ICD-10 → HCC; enforce MEAT criteria; and reduce audit exposure. (CMS publishes model codes and software for CMS-HCC, which our mappings follow.) Centers for Medicare & Medicaid ServicesProvider Workflow Fit

Point-of-care prompts, chart review queues, and feedback loops help clinicians document once, correctly supporting MSSP quality reporting and downstream encounter integrity. Centers for Medicare & Medicaid ServicesSubmission & Reconciliation

Clean EDI lifecycles (837/277/999) and encounter analytics ensure traceable, CMS-ready data—so your risk capture shows up in benchmarks and settlement. (Diagnosis-level files must contain eligible ICD-10 codes per CMS instructions.) Centers for Medicare & Medicaid ServicesPopulation & Equity Analytics

Flag high-risk cohorts, close care gaps, and track performance signals relevant to ACO programs—including initiatives supporting primary care and underserved communities.